Us paycheck calculator

Payroll check calculator is updated for payroll year 2022 and new W4. Dont want to calculate this by hand.

Paycheck Calculator Take Home Pay Calculator

Then enter the employees gross salary amount.

. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and. Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator.

See how much youll expect to take home after taxes with this free paycheck calculator. If you have questions about Americans with Disabilities Act Standards for Accessible Design please contact 916 372-7200 or PPSDWebmasterscocagov. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

It can also be used to help fill steps 3 and 4 of a W-4 form. Dont want to calculate this by hand. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

This calculator is intended for use by US. Paycheck Calculator is a great payroll calculation tool that can be used to compare net pay amounts after payroll taxes in different states. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Enter your annual salary or earnings per pay period. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. This calculator will help hourly workers decipher their paycheck.

The PaycheckCity salary calculator will do the calculating for you. This number is the gross pay per pay period. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

Figure out your filing status. Enter the required information into the form to instantly get your results. Send us a message.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The PaycheckCity salary calculator will do the calculating for you. Overview of Georgia Taxes Georgia has a progressive income tax system.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes. Subtract any deductions and payroll taxes from the gross pay to get net pay. If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Usage of the Payroll Calculator. You can also use the calculator to calculate hypothetical raises adjustments in retirement contributions new dependents and changes to health.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Enter your pay rate. You can use the calculator to compare your salaries between 2017 and 2022.

This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. The calculator is updated with the tax rates of all Canadian provinces and territories. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

The amount can be hourly daily weekly monthly or even annual earnings. There are two paycheck calculators that compute paychecks for employees in Illinois and New York. This number is the gross pay per pay period.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Our free salary paycheck calculator see below can help you and your employees estimate their paycheck ahead of time.

North Carolina Paycheck Calculator. Exempt means the employee does not receive overtime pay.

Tax Payroll Calculator Top Sellers 50 Off Www Wtashows Com

Free Paycheck Calculator Hourly Salary Usa Dremployee

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Free Paycheck Calculator Hourly Salary Usa Dremployee

Tax Payroll Calculator Top Sellers 50 Off Www Wtashows Com

Payroll Calc Hotsell 58 Off Www Wtashows Com

Tax Payroll Calculator On Sale 53 Off Www Wtashows Com

Tax Payroll Calculator Top Sellers 50 Off Www Wtashows Com

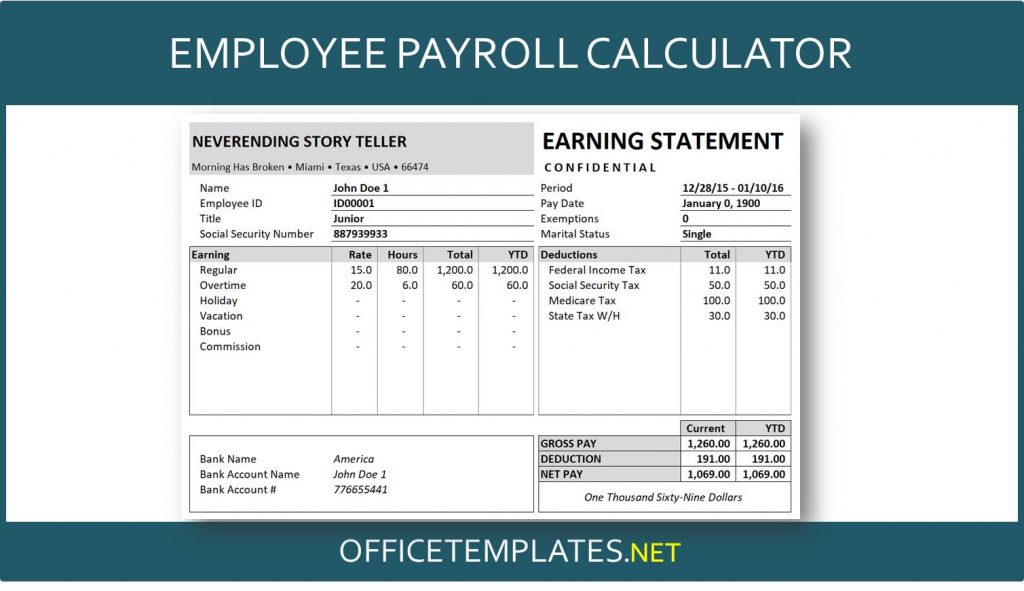

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Tax Withheld Calculator Flash Sales 57 Off Www Wtashows Com

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

1wxmydejhzto9m

Paycheck Calculator Take Home Pay Calculator

Tax Withheld Calculator Flash Sales 57 Off Www Wtashows Com

Hourly Payroll Calculator On Sale 56 Off Www Wtashows Com